Security Resources and Circular Economies

*this article was originally posted on Mirror on 2023/10/09*

Key Insights

$15 million of daily sell pressure is applied to BTC to account for miners’ external overhead costs. This capital leaves the Bitcoin ecosystem to pay for security.

A shift in focus from Sybil resistance mechanisms (PoW vs. PoS) to the source of security resources (exogenous vs. endogenous) provides a more meaningful framework for evaluating consensus mechanisms and economic sustainability.

Endogenous security resources offer a more sustainable and economically efficient approach than exogenous resources, which has implications for existing and upcoming shared security models.

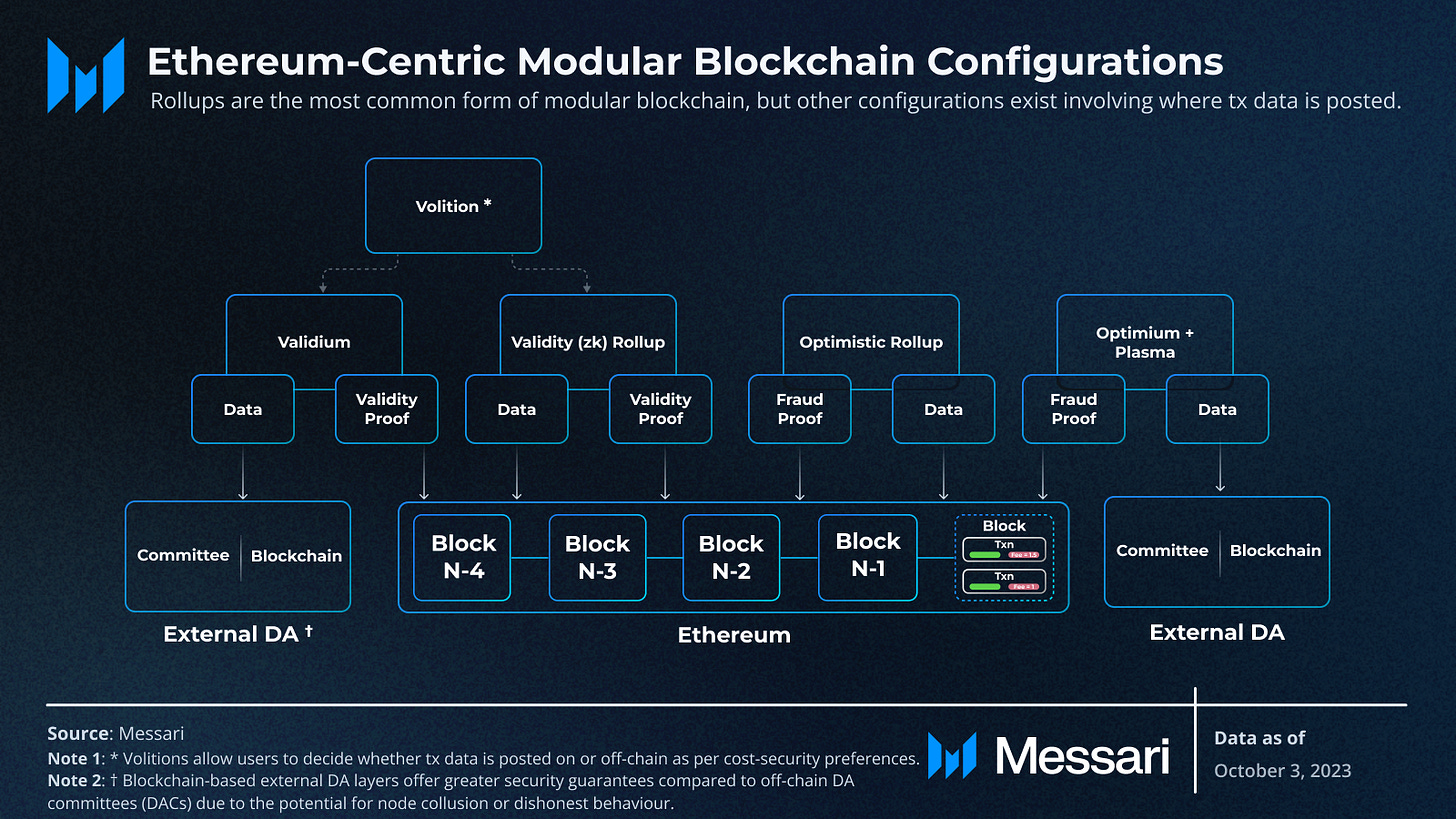

$100,000+ of capital is extracted from rollup ecosystems on a daily basis. This capital is extracted as L1 fees for settlement/security.

Shared security models, even if they employ PoS, economically resemble Bitcoin's PoW model if they rely on exogenous security resources, emphasizing the importance of resource origin.

This capital drain is an economic risk factor for holders of native tokens from rollups, parachains, Atom Economic Zone networks, subnets, etc. Ideological alignment is vital, but not all child chains need their own token.

Blockchain Security

Blockchain security can be broadly categorized into two essential properties: "safety" and "liveness."

Safety in blockchain refers to the unchangeable consensus on transaction history, preventing issues like double-spending. Safety can be thought of as corruption-resistance.

Liveness ensures that the network remains operational, processing transactions despite network hiccups. Liveness can be thought of as a network’s uptime.

As a simplification, decentralization (by geography, node client software, infrastructure, etc.) mostly determines liveness, and consensus mechanisms mostly determine safety; although, in practice, the two are deeply integrated. Security framed as economic sustainability is better explored through consensus mechanisms (decentralization can be further explored here).

Consensus mechanisms are designed to enable a distributed set of nodes to agree on the state of a blockchain and enforce the validity of that state. In general, consensus mechanisms achieve safety by making it expensive to manipulate the blockchain. Sybil resistance mechanisms, such as PoW and PoS, are arguable to most debated dimensions of consensus and, by extension, security as a whole. Sybil resistance refers to the ability of a system to prevent a single actor from assuming multiple identities in order to subvert the network's functionality. These mechanisms are even commonly mistaken for entire consensus mechanisms.

Traditionally, Sybil resistance mechanisms also implied the origin of security resources, i.e., PoW used exogenous security resources (such as with Bitcoin), and PoS used endogenous security resources (such as with Ethereum). However, this is no longer the standard with the introduction of various new PoS shared security models. Today, as one no longer implies the other, the more nuanced framing of consensus mechanisms is the origin of the security resources (endogenous vs. exogenous) rather than Sybil mechanisms (PoW vs. PoS).

Aside from Sybil resistance mechanisms and origins of security resources, additional components of consensus mechanisms include block author selection, block verification process, fork-choice rule, incentive structure, network propagation, and finality.

PoW vs. Exogenous Security Resources

In a PoW system, Sybil resistance is maintained through computational work. Since a significant amount of computational power and, by extension, electricity is required to solve the complex mathematical problems in PoW, it becomes economically unfeasible for a single actor to control enough computing power to attack the network.

Bitcoin's Proof-of-Work (PoW) consensus mechanism relies heavily on exogenous security resources, namely electricity. This external dependency effectively drains capital from the Bitcoin ecosystem to pay for these resources.

It’s worth noting that while ASIC hardware is an exogenous resource, it functions similarly to endogenous resources in that this resource cannot be reallocated elsewhere. Investing in ASIC hardware for mining creates an economic lock-in effect, as the hardware is specialized for a particular blockchain and cannot be repurposed. This financial commitment incentivizes miners to align ideologically with the network, promoting its long-term stability and success. This strong aspect of Bitcoin’s security is better attributed to the origin of security resources than the Sybil resistance mechanism.

PoS vs. Endogenous Security Resources

In a PoS system, Sybil resistance is achieved through the staking of tokens. An actor would need to acquire a significant portion of total staked tokens to have a chance at compromising it. Staking also creates an economic lock-in effect, theoretically aligning their incentives with maintaining a trustworthy system.

In Ethereum’s PoS, rather than leveraging an exogenous resource (like electricity or hardware), an endogenous security resource is utilized: Ether. By doing so, Ethereum ensures that the capital remains within its ecosystem, enhancing its sustainability and resource efficiency.

Importantly, the overhead and capital drain of using exogenous resources is not exclusive to PoW. PoS systems secured by exogenous resources are subject to the same issues as traditional PoW. Using staked Ether to secure a network other than Ethereum, such as via Eigenlayer staking, would also put a capital drain on the ecosystem, moving capital out of the Eigenlayer-secured network and into Ethereum.

Staking (and issuance/inflation) on Ethereum is economically equivalent to a tax on Ether holders that don’t stake, paid to Ether holders that do stake. By extension, staking Ether to secure a separate network is effectively a tax on the separate network, paid to the Ethereum ecosystems (stakers). As such, when evaluating the long-term viability and robustness of blockchain networks, it may be more fruitful to focus on the origin of security resources rather than solely on the type of Sybil resistance mechanisms in use.

The Economic Burden of Exogenous Security Resources

In shared security models, a child chain typically rents security from a parent chain, (typically) using exogenous resources for its security, even within a PoS system. This makes the child chains more akin to PoW networks in terms of capital outflow, altering their capital efficiency and sustainability. Hence, the key factor is not the type of Sybil mechanism used but rather the origin of the security resources—exogenous or endogenous—in assessing the economic viability of these child chains.

Circular Economies

Endogenous security resources enable circular economies. Shopping at a big chain store versus buying locally parallels the difference between how Bitcoin and Ethereum secure their networks. Just as shopping at a big chain store funnels money away from local communities and into large corporations, Bitcoin's PoW outflows capital to pay for exogenous resources, mainly electricity; the network spends its money elsewhere to keep itself secure.

In Ethereum's PoS, rather than leveraging an exogenous resource (like electricity or hardware), an endogenous security resource is utilized: Ether. The effect on Ethereum is much like how shopping locally retains capital within a community. By doing so, Ethereum ensures that the capital remains within its ecosystem, enhancing its sustainability and resource efficiency. This internal retention of value not only makes the system more self-sufficient but also creates economic incentives for stakeholders to maintain network integrity. As such, when evaluating long-term sustainability, it's more accurate to focus on the origin of security resources rather than the type of Sybil resistance mechanisms (e.g., PoW or PoS) in use.

Despite using PoS, many child chains in shared security models do not have circular economies, and their native tokens suffer from it. Rollup fees accrue to ETH stakers; AEZ fees (e.g., Stride) accrue to ATOM stakers; Stacks fees accrue to Bitcoin miners; Subnets and Parachains suffer from opportunity costs.

PoW

BTC miners are issued 900 BTC daily. This system effectively works as a tax on BTC holders paid to BTC miners. To make matters worse for holders, even under the assumption that miners are all members of the ecosystem (and not-for-profit corporations with no alignment to the Bitcoin community), this capital is removed from the Bitcoin ecosystem to cover external overhead costs (electricity, hardware).

At the current price of $28,000 per BTC, assuming ⅔ of BTC is sold to cover operational expenses, this equates to ~$15 million in daily sell pressure. Annualized, this ~$5.5 billion is extracted from BTC holders and from the Bitcoin ecosystem. This ⅔ assumption is based on Mara/Riot(TODO PULL SOURCE), but theoretically a market at equilibrium will see miners selling nearly all of their BTC rewards in order to cover costs as market participants optimize.

Bitcoin may soon find itself unable to afford its security overhead. Discussions around tail emissions, drivechains, and various fee-generating mechanisms exist largely for this reason.

If Ethereum had not merged from PoW to PoS, it would still have ~$22 million in daily sell pressure, based on a 13,500 ETH daily issuance to stakers and a price of $1,600 per ETH. Due to the use of GPUs, it’s speculated that profit margins were lower for Ethereum miners, and a much higher percentage of rewards had to be sold to cover miner overhead costs.

Capital Drain in the Wild

Ethereum rollups pay roughly $100,000 in Ethereum L1 sequencer fees every day. This value would otherwise accrue to rollup token holders if they were not paying Ethereum for its security. On average, over 50% of rollup transaction fees are going to Ethereum

ATOM stakers get a 15% cut of all Stride rewards

Bitcoin miners receive Stacks rewards in the form of STX. Stacks’ PoX consensus is similar to merge-mining in that a miner on the parent chain (i.e., Bitcoin) can carry out an attack without risk of financial loss. This occurred when F2Pool started to only include commitments from their own Stacks miner, collecting a disproportionate amount or even all of the rewards.

Parachains don’t directly outsource capital to the Polkadot Relay Chain in the form of fees. Instead, it’s better described as an opportunity cost. DOT must be locked in auctions to reserve a Parachain slot that could be otherwise spent on development or anything else.

The EigenLayer thesis is that fragmenting security is bad. It allows the restaking of Ether to secure other networks by placing ETH stakers under additional slashing conditions. Networks using Eigenlayer for security are paying fees to Ethereum miners rather than their own.

Source: Messari

Exogenous Staking Is Still Better Than Mining

PoS shared security with exogenous security resources is still superior to Bitcoin-esq PoW in several ways, including wealth centralization, resource efficiency, and resilience to repetitious attacks.

While wealth centralization is a common criticism of PoS, PoW is more prone to centralization (albeit with extra steps, another example of PoW being less efficient). The economics of large-scale mining operations are inherently geared towards greater profitability through economies of scale. While in PoS systems, rewards may scale linearly with stake, large-scale miners in PoW systems can achieve superior profit margins by leveraging efficiencies in hardware, electricity costs, and other operational aspects. These efficiencies effectively mean that better-capitalized miners reap rewards that are disproportionately larger compared to their smaller counterparts, leading to a centralization of mining wealth and power.

PoS is more resource-efficient than PoW mainly due to its lower energy consumption. PoW’s computational requirements consume far more resources in terms of energy and hardware than PoS does.

In PoW, attackers can attack the network repeatedly with no increase in cost following the first attack. The primary remedy, changing Bitcoin's hashing algorithm, is drastic and would negatively affect all miners. In PoS, slashing deters attacks and makes them increasingly more expensive to execute each time. The remedy here would be to slash the attacker or fork to continually slash, forcing them to purchase more tokens to participate in another attack.

Conclusion

The use of endogenous security resources benefits a network by improving both its resource and capital efficiency while also better aligning participant incentives with the network's long-term sustainability. Shared security models offer the advantage of resource consolidation (avoid fragmentation of security resources; allow security resources/liquidity to be collaborative rather than rivalrous) and quicker network development, but they usually function within a hierarchical system where subordinate networks have to use exogenous security resources from a parent chain. This arrangement drains capital from child networks, endangering their sustainability.

Shared security models like rollups and re-staking are most effective when there is strong ideological alignment with the parent chain. If maintaining network independence or accruing value to the native token is a primary goal, it's advisable to avoid renting security from another network. For those networks that wish to maintain financial sovereignty, collaborative security models like Mesh Security may offer a more balanced alternative to traditional hierarchical security arrangements.