Dethroning Ethereum: How to Stop Being an Eth-Testnet

*this article was originally posted on Mirror on 2023/10/24*

Key Insights

Most alt-L1s are effectively Ethereum testnets. Ethereum’s flexible and adaptable community ethos allows it to adopt innovations from other networks.

Solana is building an ultra-high throughput network. Solana achieves this not just by adapting its VM but by increasing node requirements.

This design choice is incompatible with the Ethereum ethos, meaning Ethereum may defer new sectors/narratives to Solana, as Bitcoin did to Ethereum with programmability in general.

To avoid being glorified Ethereum testnets, other networks should focus on design choices that Ethereum would be unwilling to implement rather than design choices that Ethereum does not currently follow.

Summary:

Beating a strong network effect requires an innovative approach. By choosing not to add programmability, Bitcoin deferred most crypto sectors and narratives to Ethereum, such as DeFi, NFTs, and gaming. Since then, Ethereum has established itself as the new incumbent (chain-to-beat) and has a comparable network effect to Bitcoin. The Ethereum community has been happy to adapt the base layer, and its rollup-centric roadmap is eating Eth-Killer’s lunches.

Your favorite Eth-Killer / Third-Generation Blockchain / alt-L1 is effectively an Ethereum testnet. Unless, of course, it has/finds a unique value proposition. Optimization/specialization at the execution layer is insufficient due to Ethereum’s multichain model. Optimization/specialization at other layers may be viable routes. But it’s not even enough for this value proposition to be unique; it must also be diametrically opposed to the ethos of Ethereum, or else Ethereum will simply adopt it.

To carve out their own piece of the market, other networks should focus on design choices Ethereum is unwilling to implement rather than design choices that Ethereum does not currently follow. Ultra-high throughput networks such as Solana may have the best opportunity to do this because they (typically) achieve their high speeds through increasing node requirements, which Ethereum seems ideologically opposed to. I can’t believe I’m bullposting Solana.

Disclaimer: I’m boldly running with an assumption that Ethereum’s network effect is too great to overcome in a head-to-head battle for developers/users/liquidity, i.e., Ethereum can’t be beaten at its own game. And I am aware that distributed ledger tech is very new, so there really is no established paradigm. However, I find this precondition to help isolate the value propositions of various L1 networks and explore them in a vacuum.

Bitcoin Blew a 3-1 Lead

A network effect occurs when a product or service gains additional value as more people use it. If only one person has a telephone, it's virtually useless. But as more people get telephones, the utility of each phone increases exponentially because each user can potentially communicate with a larger number of people. Blockchain networks also feature this positive feedback loop.

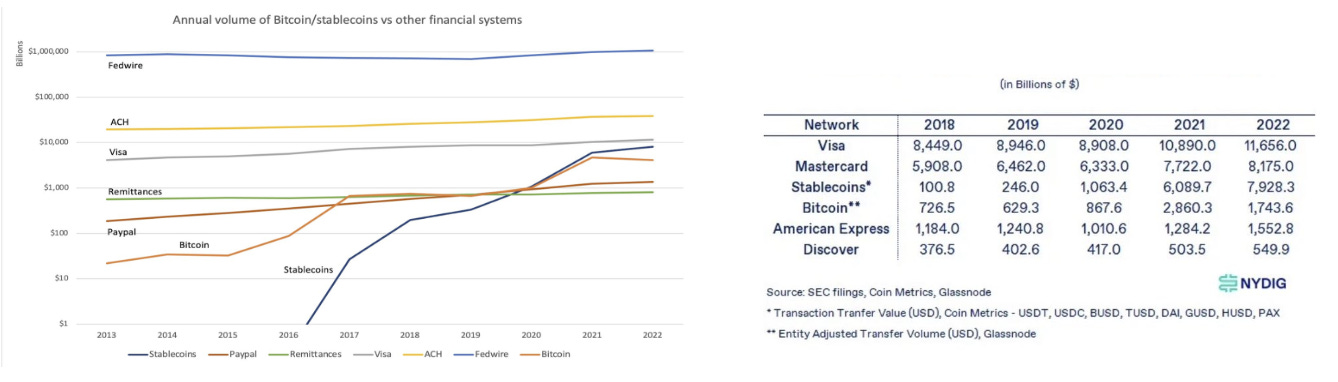

Bitcoin’s network effect is massive: brand, adoption, recognition, financial infrastructure, liquidity. But while Bitcoin has surpassed some TradFi incumbents in terms of transfer volume, it’s not even the top crypto solution; that would be stablecoins.

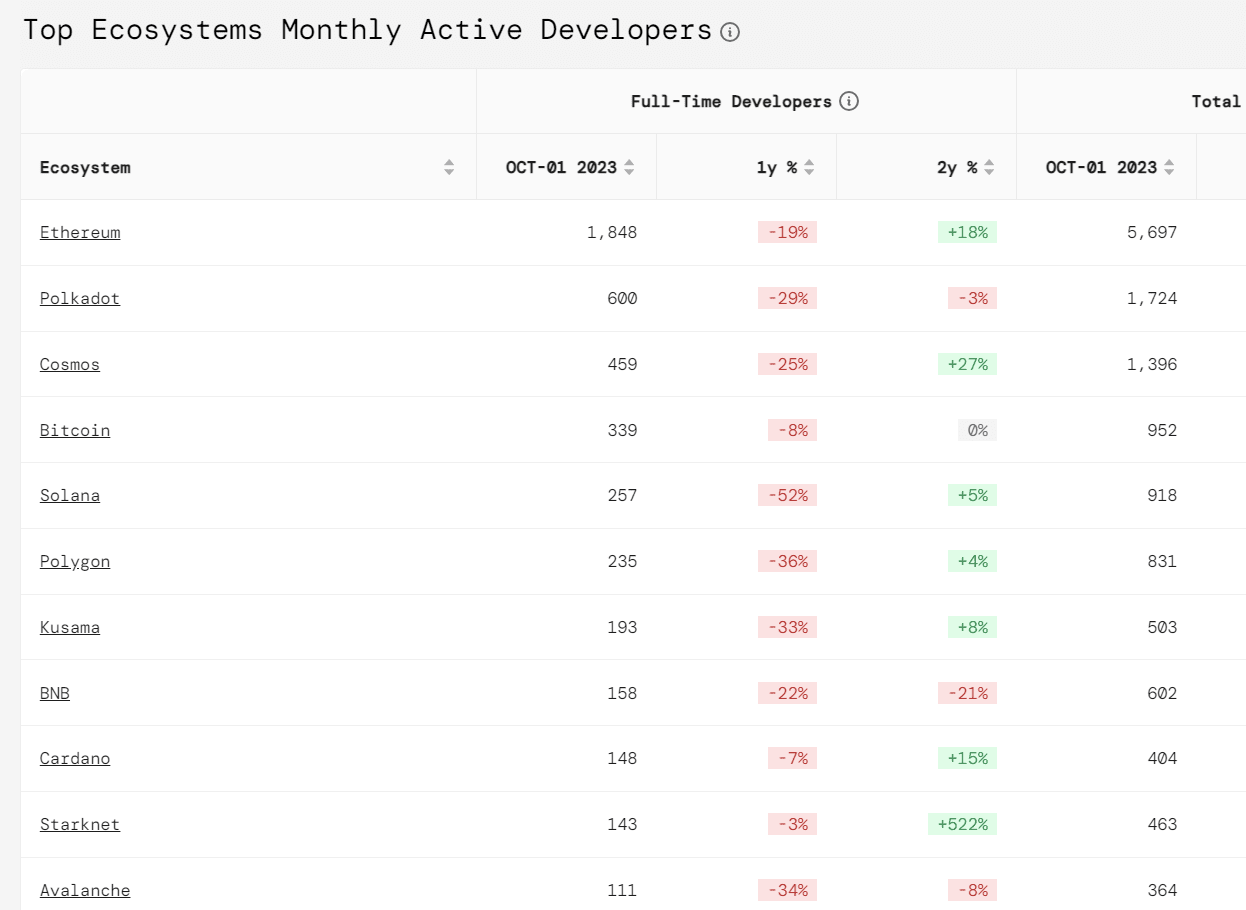

Ethereum and the EVM have greatly exceeded Bitcoin in several important categories.

Activity: Ethereum has averaged 1.05 million daily transactions over the last 12 months, compared to Bitcoin’s 0.36 million [Coin Metrics].

Liquidity: Ethereum has $42.78 billion in TVL ($20.49 billion if not counting protocols built on Ethereum) as of October 2023, compared to Bitcoin’s $0.20 billion [DefiLlama].

Developers: Ethereum has 1,848 full-time developers as of October 2023, compared to Bitcoin’s 339 [Electric Capital Developer Report].

Some sectors, such as community and mindshare, are harder to quantify but can be argued in favor of Ethereum.

This transition was possible because Bitcoin made the conscious decision to forego programmability. If Ethereum tried to beat Bitcoin at its own game (solely P2P transactions or later store of value), it would have looked like Nano or Litecoin. Ethereum likely would never surpass Bitcoin in activity/transfer value if it played Bitcoin’s game, but it went for programmability - something Bitcoin was unwilling (not unable, but unwilling) to implement.

Alt-L1s are Ethereum Testnets

“Proof-of-Stake, modularity, the appchain model, liquid staking, fee burning, deflationary tokenomics, rollups, sharding, data availability sampling, cool ideas! Thanks, Cosmos, Tezos, Polkadot, Celestia, [insert Eth-Killer], et all, for being guinea pigs and testing those concepts in prod. Now that the ideas are battle tested and the kinks are ironed out, we’ll take those and implement em here!” - your local Eth-maxi, probably.

That is what Bitcoin should have been doing as other networks innovated if it didn’t want Ethereum to take center stage. Eth-Killers have come to market with many innovative ideas, only to become testnets for Ethereum. Their brilliant solutions do not hurt Ethereum but are instead to the benefit of Ethereum, as their successes and failures are free lessons.

In the same way that ‘Bitcoin but faster’ currencies couldn’t dethrone Bitcoin, ‘Ethereum but cheaper’ alt-L1s couldn’t dethrone Ethereum. This is enhanced by the fact that Ethereum has a general ethos of fluidity, in contrast to Bitcoin’s ossified nature and resistance to change (speaking in generalizations of their respective communities). The fluidity of a community and willingness to hard fork are survival traits. If the idea is good enough, Ethereum will adopt it.

In the case of EVM alt-L1s, these networks have access to parts of Ethereum’s ecosystem: developers, infrastructure, and smart contracts. Small improvements were made in the hopes of capturing parts of Ethereum’s network share, usually in the form of reduced transaction fees. However, none of these changes have been radical enough to overpower the liquidity, consensus security, or community aspects of Ethereum’s network effect.

The Rollup-Centric Roadmap Took Your Lunch

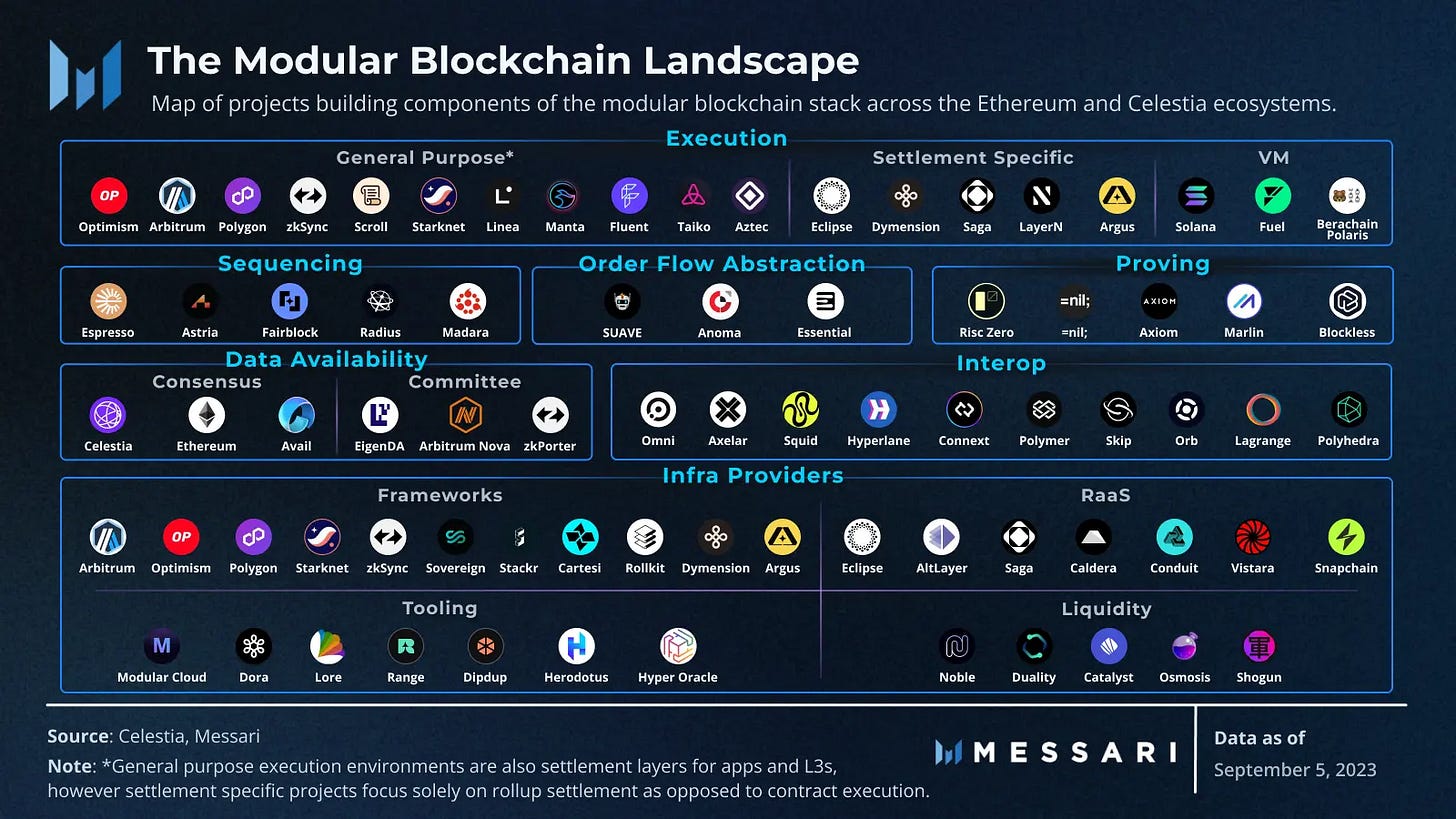

Source: Messari

Ethereum’s rollup-centric roadmap competes with nearly all versions of the Eth-Killer and renders most of them useless.

Multichain ecosystems (i.e., Polkadot, Cosmos, Avalanche) that followed the multichain and application-specific chain thesis first.

Ethereum-but-cheaper networks, such as EVM-based alt-L1s (e.g., Fantom, Polygon PoS, Pulse, Avalanche, BSC).

Ethereum-but-with-X networks, such as Aleo offering programmable privacy and Aztec building a similar platform as a rollup.

Permissioned appchains, such as Avalanche’s permissioned subnets, can also be built as Ethereum rollups.

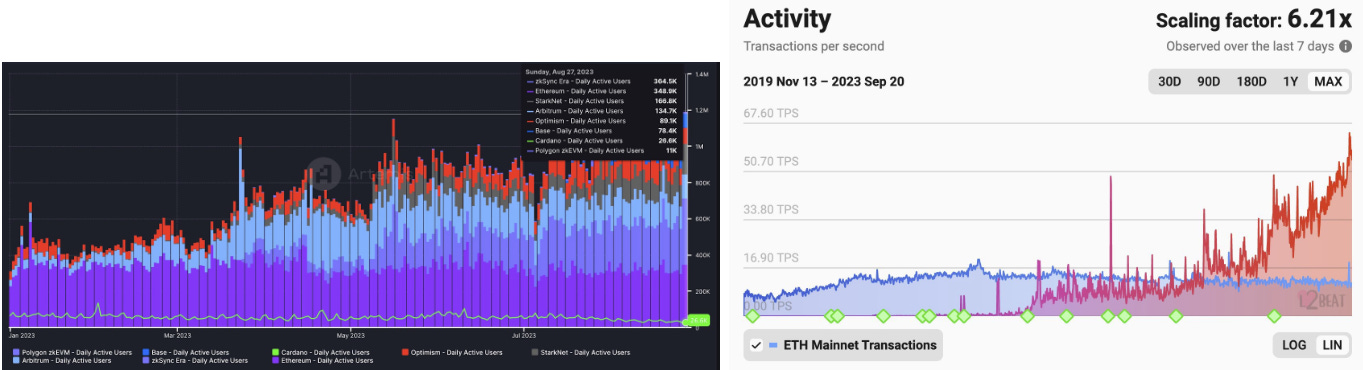

These rollups are already scaling the Ethereum ecosystem today. They’re crushing alt-L1s in activity metrics, and some are even exceeding Ethereum mainnet itself (over short periods of time).

EVM rollups do not directly parallel EVM-based alt-L1s. Many alt-L1s, like Avalanche, Binance, Polygon, etc, used the EVM to reduce onboarding friction and carry over infrastructure. Some rollups use the EVM for the same reasons, but their situation is different as they also have access to more aspects (liquidity, security, users) of Ethereum’s ecosystem.

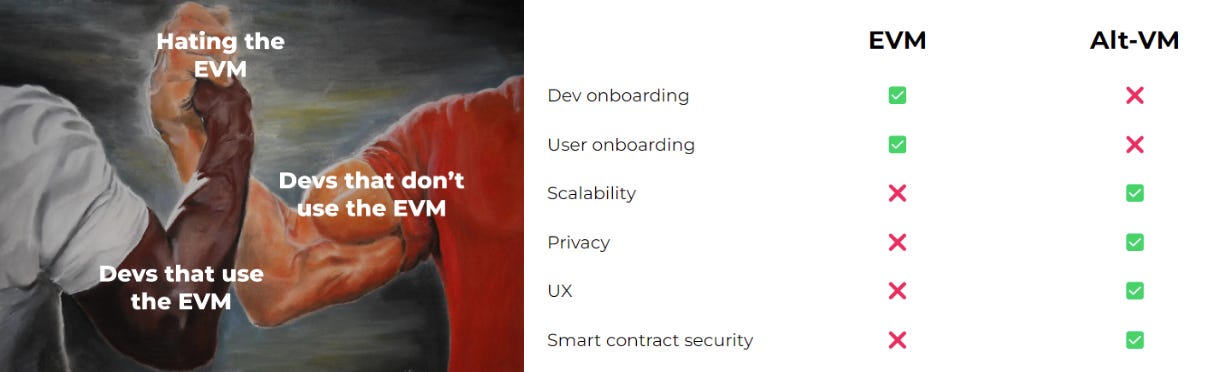

Thanks to rollups and the embrace of modularity, improvements in accounting models and VMs were rendered insufficient to dethrone Ethereum. Private execution, UTXOs, parallelism, and other core pillars of non-EVM Eth-Killers are already being implemented on alt-VM Eth rollups such as Starknet, Aztec, Eclipse, and Fuel. The VMs of these new rollups may not have all the benefits of EVM compatibility, but they still have access to other parts of Ethereum’s network effect (liquidity, consensus security, and users via safe bridging). Additionally, some bring existing VM ecosystems with them (e.g., Eclipse using the SolanaVM).

The EVM is certainly the short-term winner. However, alt-VMs are likely the medium to long-term winners. Ethereum has a clear path to ‘win’ even if the EVM doesn’t win.

All rollups are good news for Ethereum, as unlike alt-L1s, they directly drive value accrual to Ether by ‘renting’ security from Ethereum. Rollups are not circular economies.

Head Starts Won’t Save You

“Ethereum might adopt [insert alt-L1]’s VM/consensus/etc., but it won’t matter because my chain will have its own superior network effect by that point!” To speculate on that, I’ll look at Bitcoin.

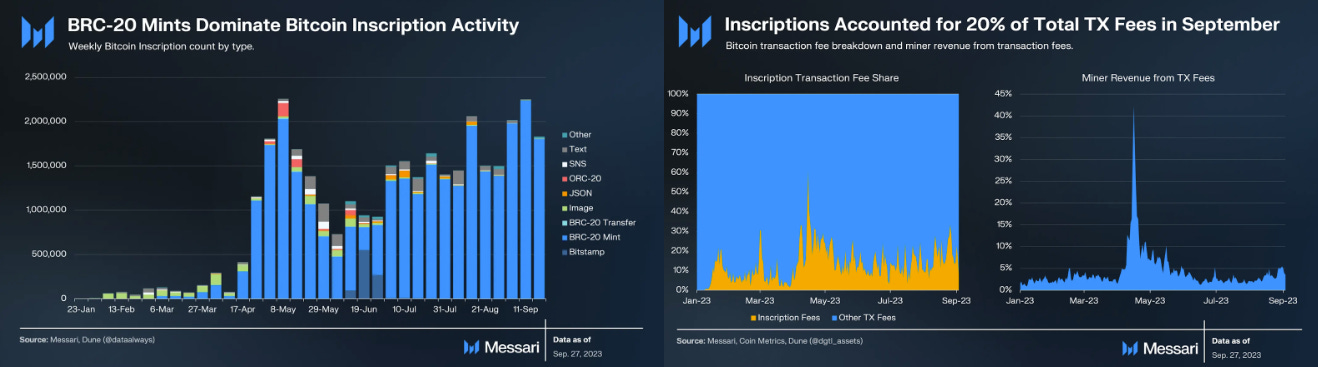

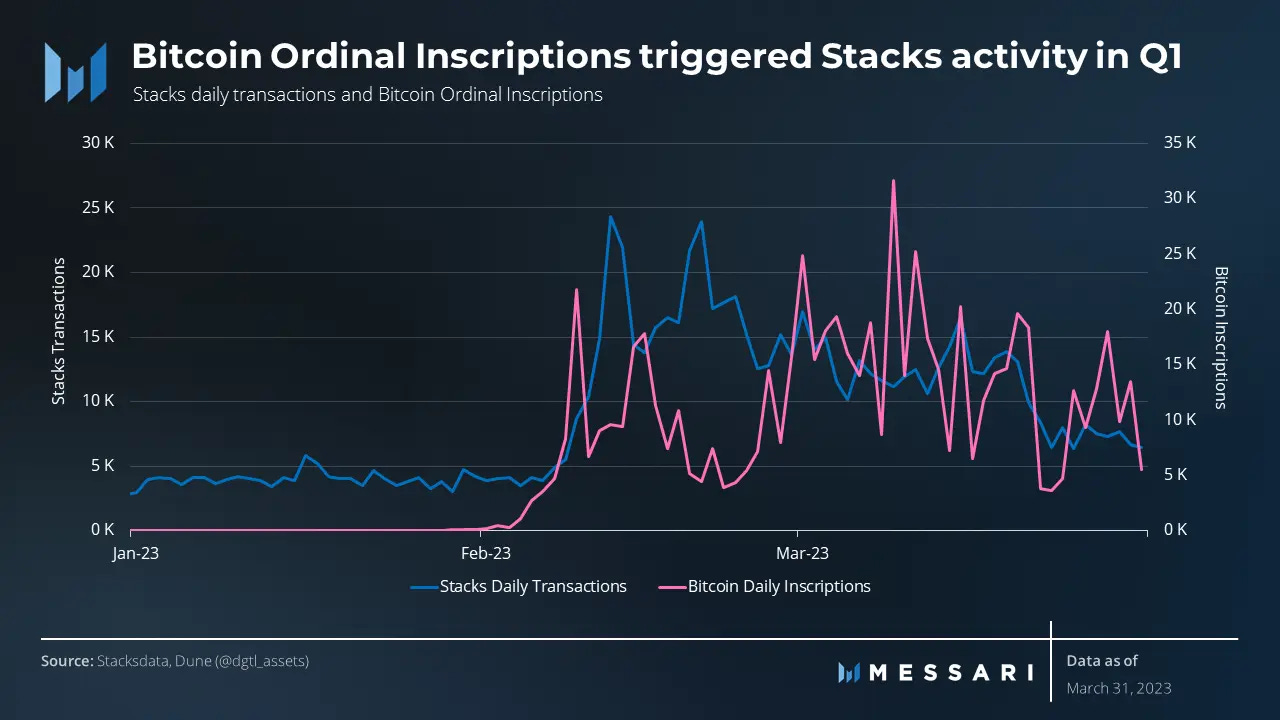

Despite Bitcoin’s strong historical opposition to programmability, hard forks, and base layer changes in general, Bitcoin is going through a programmability renaissance — catalyzed by inscriptions.

Source: Messari

Onchain, users are exploring new forms of Bitcoin programmability such as Ordinals, BRC20s, Runes, and BitVM. Some innovations, such as Ordinals, only function when paired with offchain indexing techniques/standards. BitVM is particularly interesting as it enables Turing-complete computation on Bitcoin only using existing opcodes (for my EEs, it’s just circuit theory; actually, it’s just NAND gates. Neat!).

Onchain experimentation is also breathing life into new and old offchain programmability solutions such as

Modular data availability layers (e.g., Babylon, BitcoinDA on Starknet)

Ethereum took the lead on programmability nearly a decade ago after Bitcoin deferred. Even after all that time, a few sparks in the Bitcoin world have developers and users deeply interested. Even after all this time, Ethereum has barely (or maybe even not yet) overcome the Network Effect. In the same way that devs/users that came in through Bitcoin were quick to come home from Ethereum, Ethereum users may be quick to return home from alt-L1s if/when Ethereum changes for them.

How would an alt-L1’s head start fair when Ethereum switched from PoW to PoS in just two years?

How to Dethrone Ethereum

To overcome such an adaptive incumbent, you need radical change. By positioning your alt-L1 in a way that’s diametrically opposed to the ethos of Ethereum, you can achieve things that Ethereum cannot because you know Ethereum will choose not to follow — the same way Bitcoin chose not to add programmability. That’s how you change this table:

Multichain ecosystems are definitely topping the chart here, but Ethereum has already stolen mindshare from Cosmos and Polkadot. Ethereum may even more directly copy Polkadot (i.e., shared sequencers -> the relay chain composability -> XCM and XCMP rollup frameworks/stacks -> substrate and cumulus) and succeed because of it.

We already established how execution layer innovations (VM optimizations), such as Cardano’s eUTXOs and the Solana VM, are not enough to defeat Ethereum alone. They’ll just copy it in their modular framework. Fuel is building with UTXOs (but even better, with hybridized execution), and Eclipse is straight up just using the Solana VM. We’ve also explored how Ethereum is willing to adapt aspects of its native token, consensus mechanism, and general architecture if a better idea is proposed. However, the node requirement dimension of decentralization seems to be a place Ethereum will not budge.

Ultra-High Throughput Networks

Solana, Aptos, and Sui can offer speed/throughput that Ethereum can’t (chooses not to) because they prioritize it over Ethereum’s unwillingness to yield on low node requirements. Ethereum probably can’t be beat at its own game, so these networks aim to beat Ethereum at a different game. This is how ETH gained so much dominance over BTC by beating Bitcoin at a different game.

A few examples of Solana benefitting from this strategy:

In August, Solana Pay integrated with Shopify, allowing Shopify merchants to accept Solana native USDC. Shopify accounts for around 10% of total US e-commerce, and now merchants have an essentially fee-less alternative to the 1.5%-2.5% fee standard with credit card processing.

In September, Visa announced it was expanding its USDC settlement pilot to Solana. The Visa Crypto team highlighted Solana’s cheap and predictable fees through local fee markets, parallel transaction processing, fast transaction finality, large number of nodes, and multiple validator clients as reasons they believe Solana can help power mainstream payment flows.

Almost 45 million compressed NFTs (cNFTs) were minted in Q3, a 316% QoQ increase.

Read the Messari State of Solana Q3 2023 report for more.

Various Other L1 Value Propositions

There are some other value props that I’m mentally exploring. I’m definitely not as versed with all of these other networks, so please share anything that you think I’m missing.

Governance: Polkadot and Cardano are moving governance onchain, which Ethereum seems to have no interest in. If you want onchain governance, you might come here for it.

Government/Enterprise Usage: XRP Ledger leans heavily into these two, with CBDCs and B2B solutions (e.g., Liquidity Hub).

Simplicity: Now you’re competing with Bitcoin again, but Monero and Dogecoin seem to have carved out some space for themselves with privacy and memes, respectively.

Safety: Cardano’s development approach is principally different regarding being okay with being relatively slow in favor of safety. Ethereum likes to move fast and break things, which Cardano’s peer review and Haskell-based network do not. If safety and research are deal breakers, you may come to Cardano.

Thanks to my friends Micah, Raquel, and StakeWithPride for helping me articulate these thoughts. And thank you to the Messari team for the always great insights.